Being an Independent Advisor means:

High advisory fees will significantly erode your investment returns. In order to maximize returns, a low-cost solution is essential.

Wall Street firms charge high fees because they have high overhead costs. These costs include maintaining Class A office space in every major city, enormous advertising budgets across all platforms including internet, television and print, and generous expense accounts for their most productive advisors so they can wine and dine clients and prospects. These high costs are born directly by the firms clients in the form of higher fees and commissions, but also by the firms advisors who earn gross payouts of less than 40%. In other words the advisors that manage the client assets earn just 40% of the fees that they generate.

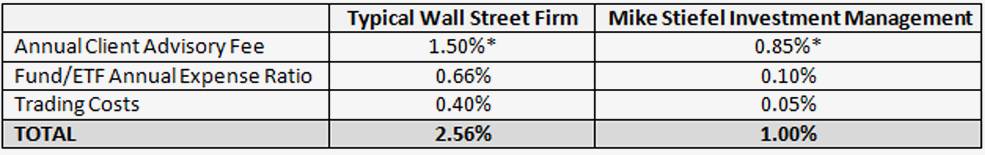

Independent advisory firms, such as ours that partner with LPL Financial, have a much lower overhead cost structure, i.e., no large advertising campaigns or excessive real estate costs. This independent’ structure allows LPL Financial to invest more capital in support of their advisors. This support includes a cutting-edge technology platform and state-of-the-art online client access portal. Most importantly, this allows advisors to pass along cost savings directly to their clients in the form of lower annual advisory fees. See the table below.

At Mike Stiefel Investment Management we provide Full Service Advice from experienced investment professionals at LESS THAN HALF the total cost of a typical Wall Street Firm. And as fiduciaries, we always put your interests first.

As a client of our firm you can expect to pay annual advisory costs of approximately 1%, all in, depending on your specific needs and the amount of assets you entrust to the firm. We provide this information on our website to illustrate our commitment to low client costs and transparency. As a client you will always know exactly where you stand and how much you are paying.

Mike Stiefel Investment Management fees represent a firm average and are for illustrative purposes only. Actual fees will vary with account size and client needs.

*Per WSJ, Forbes, Morningstar.

Client Advisory Fees quoted are for accounts less than $1 million

Interested in learning more? Contact us to get started.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/ SIPC.

The financial professional associated with this page may discuss ad/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.